American International Group Inc. lowered its holdings in Wells Fargo & Company (NYSE:WFC - Free Report) by 1.6% during the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 922,445 shares of the financial services provider's stock after selling 14,828 shares during the period. American International Group Inc.'s holdings in Wells Fargo & Company were worth $45,403,000 at the end of the most recent quarter.

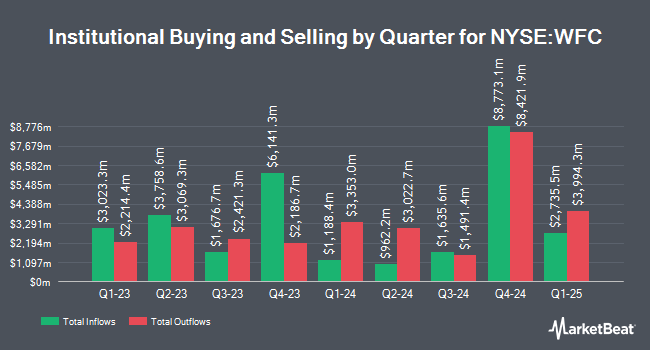

A number of other institutional investors also recently modified their holdings of the business. Abel Hall LLC bought a new stake in shares of Wells Fargo & Company during the fourth quarter valued at about $516,000. Beaird Harris Wealth Management LLC purchased a new position in shares of Wells Fargo & Company during the 4th quarter valued at $34,000. Lazari Capital Management Inc. increased its holdings in shares of Wells Fargo & Company by 0.9% in the fourth quarter. Lazari Capital Management Inc. now owns 22,804 shares of the financial services provider's stock worth $1,122,000 after purchasing an additional 202 shares during the period. Syon Capital LLC raised its holdings in shares of Wells Fargo & Company by 10.3% in the 4th quarter. Syon Capital LLC now owns 18,015 shares of the financial services provider's stock valued at $887,000 after acquiring an additional 1,685 shares in the last quarter. Finally, Integrated Advisors Network LLC lifted its position in Wells Fargo & Company by 6.2% during the fourth quarter. Integrated Advisors Network LLC now owns 28,171 shares of the financial services provider's stock valued at $1,387,000 after purchasing an additional 1,637 shares during the last quarter. 75.90% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of brokerages recently weighed in on WFC. Morgan Stanley raised their price objective on Wells Fargo & Company from $63.00 to $64.00 and gave the company an "overweight" rating in a report on Monday, April 15th. Evercore ISI increased their target price on Wells Fargo & Company from $58.00 to $67.00 and gave the company an "outperform" rating in a report on Thursday, March 28th. Citigroup restated a "neutral" rating and set a $63.00 price target (up from $57.00) on shares of Wells Fargo & Company in a research report on Wednesday, March 20th. StockNews.com upgraded Wells Fargo & Company from a "sell" rating to a "hold" rating in a research report on Monday, April 15th. Finally, The Goldman Sachs Group lifted their target price on shares of Wells Fargo & Company from $57.00 to $65.00 and gave the stock a "buy" rating in a research note on Monday, April 1st. Fourteen analysts have rated the stock with a hold rating, six have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, Wells Fargo & Company currently has a consensus rating of "Hold" and a consensus target price of $58.99.

Read Our Latest Report on Wells Fargo & Company

Wells Fargo & Company Stock Up 0.2 %

NYSE:WFC traded up $0.13 on Friday, reaching $57.40. 15,375,353 shares of the stock traded hands, compared to its average volume of 14,025,280. The company has a current ratio of 0.87, a quick ratio of 0.86 and a debt-to-equity ratio of 1.14. The company has a market capitalization of $200.11 billion, a price-to-earnings ratio of 11.98, a PEG ratio of 1.51 and a beta of 1.17. Wells Fargo & Company has a 12 month low of $38.38 and a 12 month high of $62.55. The company's fifty day simple moving average is $59.38 and its 200 day simple moving average is $54.25.

Wells Fargo & Company (NYSE:WFC - Get Free Report) last released its quarterly earnings data on Friday, April 12th. The financial services provider reported $1.20 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.10 by $0.10. The business had revenue of $20.86 billion for the quarter, compared to analysts' expectations of $20.19 billion. Wells Fargo & Company had a return on equity of 12.30% and a net margin of 15.63%. The firm's quarterly revenue was up .6% on a year-over-year basis. During the same period in the prior year, the firm posted $1.23 EPS. Equities analysts predict that Wells Fargo & Company will post 5.14 EPS for the current fiscal year.

Wells Fargo & Company Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Saturday, June 1st. Shareholders of record on Friday, May 10th were given a $0.35 dividend. This represents a $1.40 dividend on an annualized basis and a yield of 2.44%. The ex-dividend date of this dividend was Thursday, May 9th. Wells Fargo & Company's dividend payout ratio (DPR) is 29.23%.

Wells Fargo & Company Profile

(

Free Report)

Wells Fargo & Company, a financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally. The company operates through four segments: Consumer Banking and Lending; Commercial Banking; Corporate and Investment Banking; and Wealth and Investment Management.

See Also

Before you consider Wells Fargo & Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wells Fargo & Company wasn't on the list.

While Wells Fargo & Company currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.